TRACKING THE CEO OF EURO PACIFIC CAPITAL AND GOLD VIGILANTE PETER SCHIFF, AN UNOFFICIAL TRACKING OF HIS INVESTMENT COMMENTARY

Wednesday, December 30, 2020

Friday, December 25, 2020

Monday, December 21, 2020

Peter Schiff: Rigged Bond Market Sends False Signals

Fed can’t stop the dollar from falling or gold from rising.

Bitcoin isn’t gold 2.0, it’s fools gold 2.0.

- Source, Peter Schiff

Tuesday, December 1, 2020

Thursday, November 26, 2020

Sunday, November 22, 2020

Monday, November 16, 2020

Thursday, November 12, 2020

Peter Schiff: Huge Loss in Purchasing Power may Decimate Portfolios

- Source

Sunday, November 8, 2020

Peter Schiff: Dollar Dumps as Stock Market Pumps

The light at the end of the tunnel is a Mac truck.

Rally in gold stocks are a small taste of what’s ahead.

Biden has the same tricks to play as Trump.

Biden, like Trump, criticizes the stock market as a candidate and will embrace it as president.

Bitcoin gains, but its popularity doesn’t.

- Source, Peter Schiff

Friday, October 23, 2020

Tuesday, October 13, 2020

Thursday, October 8, 2020

Political Tension Puts Near Term Stimulus in Doubt

Chart looking weak for the Dow and Russell, strong for silver.

Bloom coming off the rose of economic recovery.

Political tensions rise with death of Ruth Bader Ginsburg.

US government is the biggest threat to America, not terrorists or COVID.

Fiscal stimulus requires monetary stimulus.

The constitution has to be applied, not interpreted.

- Source, Peter Schiff

Saturday, October 3, 2020

Monday, September 28, 2020

Peter Schiff: The Future of Gold, Silver and the Dollar

Friday, September 25, 2020

Tuesday, September 15, 2020

Thursday, September 10, 2020

Peter Schiff: Buffett Buys Barrick Gold, Sells Banks

Food prices soar and this is just the beginning. Fair-weather capitalists claim we’re all socialists now.

Socialism is Larry Kudlow’s new credo, now that he works for the government.

Warren Buffet is too smart to buy bitcoin. California wants to tax out of state residents' wealth.

- Source, The Peter Schiff Show

Sunday, September 6, 2020

Wednesday, September 2, 2020

Peter Schiff: Massive Shakeout in Gold and Silver

- Source, Peter Schiff

Saturday, August 29, 2020

Peter Schiff vs James Rickards: Inflation or Deflation?

Jim Rickards, best-selling author, said that the Fed has failed to deliver inflation in the past when there was monetary stimulus, while Peter Schiff, CEO of Euro Pacific Capital, argued that inflation of asset prices is the likely outcome.

- Source, Kitco

Tuesday, August 25, 2020

Peter Schiff: The Coming Monetary Collapse, You've Been Warned

In this second segment of the three-part interview, Rickards and Schiff discuss the consequences of the Federal Reserve paying for the nation’s expenses, or as Schiff called it, “free money.”

- Source, Kitco News

Friday, August 21, 2020

Peter Schiff and James Rickards Forecast: $15000 Gold is Coming

Rickards’ analysis gives a five-year gold price target of $15,000 an ounce. Schiff, too, sees this as just the start of the bull cycle, adding that an imminent U.S. dollar collapse will be a major catalyst in sending gold prices much higher.

- Source, Kitco News

Sunday, August 2, 2020

Peter Schiff: Gold Keeps Knocking on 1800's Door

Massive support built for gold’s bull market. Gold stock fundamentals continue to improve. Fascism is Socialism.

- Source, The Schiff Report

Wednesday, July 29, 2020

Peter Schiff: Jobs and Stocks Are Nothing to Brag About

- Source, Peter Schiff

Friday, July 24, 2020

Tuesday, July 21, 2020

Peter Schiff: The V-Shaped Recovery Narrative is Falling Apart

It's Puerto Rico that would have five. As I predicted, US stock market continued to be under pressure throughout the week. Financial stocks lead lower by Goldman Sachs.

Companies that can’t make money need to go out of business. Betting odds overwhelmingly favor Democrats victory in White House and Senate. House of Representatives pass bill to make Washington D.C. the 51st state.

When Republicans lose the Senate in November, they may never get it back. Elizabeth Warren has inside track on Secretary of Treasury in Biden cabinet. Euro Pacific funds made up for 5 years of under performance in 6 months.

- Source, the Peter Schiff Show

Monday, July 20, 2020

Peter Schiff: Confiscatory Taxation is Coming

China may cut US from trade. China propping up US dollar so US may not be able to buy from anyone soon.

600 financial firms took forgivable PPP loans.

Entrepreneurs created the middle class.

Biden wants equal outcomes, not equal treatment.

Estate Tax is unconstitutional . Big tax hikes are coming.

- Source, the Peter Schiff Show

Thursday, July 16, 2020

Saturday, July 11, 2020

Tuesday, July 7, 2020

Peter Schiff: Fed buying junk bonds to reward speculators

We’re in the lull before the storm. Dollar crash looming. I touched the third rail and the mob has come to get me fired. The bar has been lowered, letting real racists off the hook.

- Source, The Schiff Report

Friday, July 3, 2020

Peter Schiff: During bad times, a good Fed Chair is not popular

- Source, Peter Schiff

Monday, June 29, 2020

Peter Schiff: Fade the Fed and How to Profit from the Coming Stagflation

We are in a period of great upheaval, strife and angst, in which fiat money printing is truly out of control.

In this presentation hosted by Cambridge House International, Peter Schiff touches on the coming chaos that is rapidly approaching and the chaos that is already at our front door.

The Federal Reserve is out of control and they have no true solutions to the problems at hand.

How do you profit and persevere in the coming madness? Watch, listen and learn.

- Video Source, Peter Schiff

Tuesday, June 23, 2020

FED Is Printing Dollars Out of Control, Which Will Lead To Its Collapse

Time is running out and now some people are starting to sound the alarm about the US dollar. This time, Peter Schiff repeated his thesis about the imminent collapse of the US dollar and FED monetary policy.

The US government's response to the crisis caused by the COVID-19 pandemic has only accelerated this process. Previously, Peter was alone in calling for the future collapse of the US dollar, but now everything seems to be changing. An article by the Yale economist Stephen Roach, which was published on Bloomberg, confirms Peter's earlier concerns.

Roach claims that the collapse of the US dollar is inevitable. Americans are waiting for the strongest change in living standards. Roach is afraid of the growing deficit of the US state budget. And the situation after the pandemic, this value is at a critical point. And even with this dynamic, they are ahead of Federal spending.

"The coming collapse in saving points to a sharp widening of the current-account deficit, likely taking it well beyond the prior record of -6.3% of GDP that it reached in late 2005."

The US government's response to the crisis caused by the COVID-19 pandemic has only accelerated this process. Previously, Peter was alone in calling for the future collapse of the US dollar, but now everything seems to be changing. An article by the Yale economist Stephen Roach, which was published on Bloomberg, confirms Peter's earlier concerns.

Roach claims that the collapse of the US dollar is inevitable. Americans are waiting for the strongest change in living standards. Roach is afraid of the growing deficit of the US state budget. And the situation after the pandemic, this value is at a critical point. And even with this dynamic, they are ahead of Federal spending.

"The coming collapse in saving points to a sharp widening of the current-account deficit, likely taking it well beyond the prior record of -6.3% of GDP that it reached in late 2005."

- Stephen Roach, economist

- According to the author, the fall of the dollar will have three big consequences.

- The first is inflation. An oversupply of currency will lead to a sharp increase in unsecured prices for goods and services

- Second, the trade deficit will impose additional tax obligations on customers.

- Third, in trying to get rid of China, the main financing of the American debt is lost

Earlier, Peter called for abandoning the US dollar in favour of buying gold and stock.

- Source, The Tradable

Friday, June 19, 2020

Stage Now Set for USD Crash: Peter Schiff

The CEO of Euro Pacific Capital and renowned Bitcoin critic Peter Schiff has tweeted that the current circumstances are showing a deep USD crisis which threatens to bring on a USD crash soon.

He also comments on the numerous suggestions to defund the police in the US, while the Binance CEO mentions the negative 2020 events as being beneficial for Bitcoin growth and wider BTC adoption.

‘The stage is now set for a dollar crash’

Peter Schiff has taken to Twitter to share some more negative thoughts on the current economic situation and the civil unrest in the US.

In particular, he has once again shared his skeptical take on the future of the USD. Schiff has expressed the root of his doubts many times and is not the only expert who has these beliefs. They stem from the fact that the Fed has printed over six trillion USD in this recent crisis caused by the pandemic that originated in China and quickly spread to major European and Asian countries and led to a quarantine.

Speaking on the injection of newly printed USD into the economy, Schiff said that after the Fed happily satisfied the demands for USD, the result was “a glut of U.S. dollars that no one needs or wants.”

Schiff summarized that the situation could lead to a crash of the dollar.

While Peter Schiff is a Bitcoin critic and does not believe in BTC, the head of Binance, Changpeng Zhao, has, on the contrary, mentioned Bitcoin as a possible winner in the aftermath of the present 2020 issues.

Like many, including Peter Schiff in his earlier tweets, CZ expects hyperinflation to break out and big trouble for small retail businesses. But, it seems he reckons it will be good for the flagship cryptocurrency.

He also comments on the numerous suggestions to defund the police in the US, while the Binance CEO mentions the negative 2020 events as being beneficial for Bitcoin growth and wider BTC adoption.

‘The stage is now set for a dollar crash’

Peter Schiff has taken to Twitter to share some more negative thoughts on the current economic situation and the civil unrest in the US.

In particular, he has once again shared his skeptical take on the future of the USD. Schiff has expressed the root of his doubts many times and is not the only expert who has these beliefs. They stem from the fact that the Fed has printed over six trillion USD in this recent crisis caused by the pandemic that originated in China and quickly spread to major European and Asian countries and led to a quarantine.

Speaking on the injection of newly printed USD into the economy, Schiff said that after the Fed happily satisfied the demands for USD, the result was “a glut of U.S. dollars that no one needs or wants.”

Schiff summarized that the situation could lead to a crash of the dollar.

Like many, including Peter Schiff in his earlier tweets, CZ expects hyperinflation to break out and big trouble for small retail businesses. But, it seems he reckons it will be good for the flagship cryptocurrency.

- Source, u.today

Monday, June 15, 2020

The Stock Market Is Waving a Giant Red Flag. Will You Ignore This One Too?

The stock market’s miraculous recovery over the past two months comes with one nasty side-effect: extreme over-valuation risks.

S&P 500’S Frothy Valuation

By Monday’s open, the S&P 500’s price-to-earnings (P/E) ratio had reached 23.00. In other words, the index is trading at 23 times forward earnings–the highest since mid-2001.

The P/E ratio measures a company’s current share price relative to its per-share earnings. A high P/E often means that a market’s current price is not justified by its earnings outlook.

The elevated P/E comes even as many corporations revised or pulled their forward guidance due to the pandemic. As of Friday, 27 S&P 500 companies had issued negative earnings guidance for Q2 compared with 21 that issued positive guidance.

An ‘Uncomfortable’ Rally

Stocks have rebounded more than 43% from their March lows thanks to unprecedented Federal Reserve intervention and optimism about a broad economic resurgence. The bulls were vindicated on Friday after the Labor Department reported a net gain of 2.5 million jobs in May.

As the S&P 500 inches closer to record highs, Allianz’s Mohamed El-Erian says the rally is making him “uncomfortable.”

The economist, who correctly predicted the pandemic-driven bear market, told CNBC:

For me personally, it’s an uncomfortable bet to continue to bet on a huge recovery… I don’t like doing this. But I respect and admire those who can.

Despite their ‘win-win’ attitude, investors are failing to consider the long-term impact of Fed intervention in the market.

The Fed’s balance sheet has been growing since September when the overnight repo market suddenly went haywire. But the pace of intervention has skyrocketed since March as all levels of government scrambled to prop up a sinking economy.

S&P 500’S Frothy Valuation

By Monday’s open, the S&P 500’s price-to-earnings (P/E) ratio had reached 23.00. In other words, the index is trading at 23 times forward earnings–the highest since mid-2001.

The P/E ratio measures a company’s current share price relative to its per-share earnings. A high P/E often means that a market’s current price is not justified by its earnings outlook.

The elevated P/E comes even as many corporations revised or pulled their forward guidance due to the pandemic. As of Friday, 27 S&P 500 companies had issued negative earnings guidance for Q2 compared with 21 that issued positive guidance.

An ‘Uncomfortable’ Rally

Stocks have rebounded more than 43% from their March lows thanks to unprecedented Federal Reserve intervention and optimism about a broad economic resurgence. The bulls were vindicated on Friday after the Labor Department reported a net gain of 2.5 million jobs in May.

As the S&P 500 inches closer to record highs, Allianz’s Mohamed El-Erian says the rally is making him “uncomfortable.”

The economist, who correctly predicted the pandemic-driven bear market, told CNBC:

For me personally, it’s an uncomfortable bet to continue to bet on a huge recovery… I don’t like doing this. But I respect and admire those who can.

Despite their ‘win-win’ attitude, investors are failing to consider the long-term impact of Fed intervention in the market.

- Source, CCN

Friday, June 12, 2020

Peter Schiff: The Rising Stock Market Is Not A Sell Signal For Gold

US stock markets continued their inexplicable rally despite the economic destruction wrought by the coronavirus-induced shutdown. The S&P 500 is only down about 3.5% on the year and the Nasdaq is actually up. As a result, a lot of investors seem to be getting out of safe havens, including gold. But in his podcast, Peter Schiff explains why selling gold is a mistake if you understand what's really going on. In a nutshell, stocks are rising because the Fed is printing money. And no matter what the mainstream says, money printing matters.

Think about what has happened over the last year and ask yourself: does this make any sense?

Looking back at the end of 2019, people were optimistic. The stock market was booming. There was no sign of a recession in sight. But since then, the US economy has plunged into the worst recession since the Great Depression sparked by a global pandemic. Over 40 million people have filed for unemployment. The Federal Reserve is printing dollars at breakneck speed. The federal government has run up trillions of dollars in new debt through borrowing for stimulus and bailouts. And we've seen major civil unrest with looting and destruction in many major American cities.

If you were told all of this was going to happen back in January, would you have believed the S&P 500 would barely be down and that the Nasdaq would be up some 8%?

There is only one explanation.

"The only reason the market is rallying is because of the Fed. I mean, people can try to say, 'Well no, the market is anticipating a recovery.' This is a lot more than the anticipation of a recovery. This is the Fed driving the narrative, driving the market higher."

There was a bit of data that came out Wednesday that injected some optimism about a recovery into the markets and helped boost stocks. The ADP private payroll report came out. The expectation was for another 8.6 million jobs lost, but the number came in at just below 2.7 million jobs.

Peter said that number doesn't even look possible given that we've seen 2 to 3 million people file for unemployment every week. Nevertheless, as soon as the number came out, the market rallied and gold sold off. The sentiment seemed to be that the economy isn't as bad as we thought.

"The economy is as bad as they thought. In fact, it's probably worse. But when the number came out, the market rallied on it because of, I think, the momentum that has been created by the Fed."

Peter said stocks are way overpriced even if the economy was much better than people thought.

"Remember, the US stock market was overpriced at the end of 2019, before any of this bad stuff had happened. And now we have all this bad stuff, which is much worse than anybody could have possibly envisioned, and the market is barely down in the case of the S&P 500. And in the case of the Nasdaq, the market is actually higher. Even though it was already expensive and priced for perfection, we got the antithesis of perfection, yet the market went up anyway."

Meanwhile, the dollar is getting pounded and the bond market is also feeling the pressure. The yield on the 30-year appears to be pushing toward 2%. That is still low, but keep in mind, not too long ago that yield was below 1%.

Incidentally, this is a problem for the Federal Reserve. The central bank bought a lot of Treasuries when the yield was under 1%. One of the reasons the market went up was because of all the money the central bank printed to buy up those bonds. Now, as rates rise, the Fed is losing money because it has taken on a lot of interest rate risk. As interest rates rise, bond prices fall. That means the Fed's balance sheet is losing money.

Ultimately, we're seeing the market move away from safe havens and that includes gold and silver. This is due to unwarranted optimism about an economic rebound. But Peter said he thinks it's just the rise in the market itself that is creating the optimism.

"People are thinking that the market is rising because people are optimistic about the recovery. I think people are optimistic about the recovery because the market is rising. And the market is not rising because of the recovery. The market is rising because of the Fed - because of all the money the Fed is printing. And even though a lot of people think printing money doesn't matter, printing money matters a lot. And people are about to find out the hard way just how much it really matters."

This is why investors should buy gold. It's not primarily a hedge for your stock portfolio. It's to hedge for your currency.

"Whether they live in the US and have dollars, or they live in Europe and have euros, or they live in Japan and they have Japanese yen, central banks are creating tremendous inflation. And central banks have told everybody that we are intentionally destroying the value of our money. That is our goal. We want prices to go up more. We want more inflation. We want the dollars, or the euros, or the yen that you're keeping in the bank or in your mattress somewhere - we want them to lose value. The longer you hold on to them, the more value they are going to lose. This is on purpose. This is by design. So, once the central banks have told you that's the plan, you would be a fool to cooperate."

Gold is a hedge against central banks creating inflation. It's a hedge against debasing currency. Instead of selling gold because the stock market is going up, investors need to understand why the stock market is rising.

"It's rising because the Fed is printing all this money because the Fed is creating inflation and debasing the value of currency. That is going to drive the value of gold. Gold becomes more valuable because of what the government is doing to prop up the stock market and prop up the economy. So, a strong stock market is not a sell signal for gold."

Think about what has happened over the last year and ask yourself: does this make any sense?

Looking back at the end of 2019, people were optimistic. The stock market was booming. There was no sign of a recession in sight. But since then, the US economy has plunged into the worst recession since the Great Depression sparked by a global pandemic. Over 40 million people have filed for unemployment. The Federal Reserve is printing dollars at breakneck speed. The federal government has run up trillions of dollars in new debt through borrowing for stimulus and bailouts. And we've seen major civil unrest with looting and destruction in many major American cities.

If you were told all of this was going to happen back in January, would you have believed the S&P 500 would barely be down and that the Nasdaq would be up some 8%?

There is only one explanation.

"The only reason the market is rallying is because of the Fed. I mean, people can try to say, 'Well no, the market is anticipating a recovery.' This is a lot more than the anticipation of a recovery. This is the Fed driving the narrative, driving the market higher."

There was a bit of data that came out Wednesday that injected some optimism about a recovery into the markets and helped boost stocks. The ADP private payroll report came out. The expectation was for another 8.6 million jobs lost, but the number came in at just below 2.7 million jobs.

Peter said that number doesn't even look possible given that we've seen 2 to 3 million people file for unemployment every week. Nevertheless, as soon as the number came out, the market rallied and gold sold off. The sentiment seemed to be that the economy isn't as bad as we thought.

"The economy is as bad as they thought. In fact, it's probably worse. But when the number came out, the market rallied on it because of, I think, the momentum that has been created by the Fed."

Peter said stocks are way overpriced even if the economy was much better than people thought.

"Remember, the US stock market was overpriced at the end of 2019, before any of this bad stuff had happened. And now we have all this bad stuff, which is much worse than anybody could have possibly envisioned, and the market is barely down in the case of the S&P 500. And in the case of the Nasdaq, the market is actually higher. Even though it was already expensive and priced for perfection, we got the antithesis of perfection, yet the market went up anyway."

Meanwhile, the dollar is getting pounded and the bond market is also feeling the pressure. The yield on the 30-year appears to be pushing toward 2%. That is still low, but keep in mind, not too long ago that yield was below 1%.

Incidentally, this is a problem for the Federal Reserve. The central bank bought a lot of Treasuries when the yield was under 1%. One of the reasons the market went up was because of all the money the central bank printed to buy up those bonds. Now, as rates rise, the Fed is losing money because it has taken on a lot of interest rate risk. As interest rates rise, bond prices fall. That means the Fed's balance sheet is losing money.

Ultimately, we're seeing the market move away from safe havens and that includes gold and silver. This is due to unwarranted optimism about an economic rebound. But Peter said he thinks it's just the rise in the market itself that is creating the optimism.

"People are thinking that the market is rising because people are optimistic about the recovery. I think people are optimistic about the recovery because the market is rising. And the market is not rising because of the recovery. The market is rising because of the Fed - because of all the money the Fed is printing. And even though a lot of people think printing money doesn't matter, printing money matters a lot. And people are about to find out the hard way just how much it really matters."

This is why investors should buy gold. It's not primarily a hedge for your stock portfolio. It's to hedge for your currency.

"Whether they live in the US and have dollars, or they live in Europe and have euros, or they live in Japan and they have Japanese yen, central banks are creating tremendous inflation. And central banks have told everybody that we are intentionally destroying the value of our money. That is our goal. We want prices to go up more. We want more inflation. We want the dollars, or the euros, or the yen that you're keeping in the bank or in your mattress somewhere - we want them to lose value. The longer you hold on to them, the more value they are going to lose. This is on purpose. This is by design. So, once the central banks have told you that's the plan, you would be a fool to cooperate."

Gold is a hedge against central banks creating inflation. It's a hedge against debasing currency. Instead of selling gold because the stock market is going up, investors need to understand why the stock market is rising.

"It's rising because the Fed is printing all this money because the Fed is creating inflation and debasing the value of currency. That is going to drive the value of gold. Gold becomes more valuable because of what the government is doing to prop up the stock market and prop up the economy. So, a strong stock market is not a sell signal for gold."

- Source, Peter Schiff via Seeking Alpha

Sunday, June 7, 2020

Peter Schiff: Being Able to Buy Things With Bitcoin Is Lie

Peter Schiff took to Twitter to share an article about Democratic presidential candidate Joe Biden having high chances of walloping Trump in the November elections this year.

After saying that he had been warning people about the aftermath of the pandemic’s (and Trump’s QE) harmful impact on the economy and the US population, Peter Schiff replied to a comment from a follower who suggested Bitcoin as a way out.

The Euro Pacific CEO stated that in reality, you can buy nothing with Bitcoin or any other crypto.

‘Pay with crypto is a marketing gimmick’

The main reason Schiff cites for his predictions coming true in the near future is the current unemployment rate totaling 14.7 percent. That equals a loss of 34 million jobs, which is much more than in the Great Depression in 1929-1930, as per the aforementioned article.

The Fed Reserve and Donald Trump have injected over $6 trl into the economy via a quantitative easing program, which included one-time $1,200 checks to qualifying US citizens.

Later on, the Fed Reserve announced its intention to start buying ETFs to ensure that companies’ stocks have high enough demand.

A Twitter user in the comment thread suggested that buying BTC would be a way out and a chance to avoid using cash, which may soon lose a great deal of its value.

To that, Peter Schiff responded that in reality, you have to first convert Bitcoin into fiat USD, and only then can you purchase anything. So, he insists, the narrative that you can pay for real things with BTC is a lie...

After saying that he had been warning people about the aftermath of the pandemic’s (and Trump’s QE) harmful impact on the economy and the US population, Peter Schiff replied to a comment from a follower who suggested Bitcoin as a way out.

The Euro Pacific CEO stated that in reality, you can buy nothing with Bitcoin or any other crypto.

‘Pay with crypto is a marketing gimmick’

The main reason Schiff cites for his predictions coming true in the near future is the current unemployment rate totaling 14.7 percent. That equals a loss of 34 million jobs, which is much more than in the Great Depression in 1929-1930, as per the aforementioned article.

The Fed Reserve and Donald Trump have injected over $6 trl into the economy via a quantitative easing program, which included one-time $1,200 checks to qualifying US citizens.

Later on, the Fed Reserve announced its intention to start buying ETFs to ensure that companies’ stocks have high enough demand.

A Twitter user in the comment thread suggested that buying BTC would be a way out and a chance to avoid using cash, which may soon lose a great deal of its value.

To that, Peter Schiff responded that in reality, you have to first convert Bitcoin into fiat USD, and only then can you purchase anything. So, he insists, the narrative that you can pay for real things with BTC is a lie...

- Source, U.Today

Thursday, June 4, 2020

Peter Schiff: The Next Crisis Will Happen Overnight

Ron Insana says big deficits are not a problem. Next crisis will happen overnight. Retails sales declining fast, even as shoppers hoard groceries.

Netflix and Amazon are not COVID investments. Federal Reserve illegally grabbed the authority to do what It’s doing.

Gold is at the beginning of a big rise. Buying the stock market is not contrarian. Bitcoin is not an inflation hedge.

- Source, Peter Schiff

Saturday, May 30, 2020

Ignore the CPI: Inflation is a Huge Problem

Prices will begin rising higher and sooner than most expect.

$2000 monthly UBI proposed for Americans as young as 16 years old Socialists love coronavirus even more than they love climate change.

Norwegian Airlines sets an example the US should follow. Bitcoin halves.

- Source, Peter Schiff Podcast

Tuesday, May 26, 2020

Peter Schiff: Most of the Lost Jobs Aren't Coming Back

Majority of service industry jobs are not coming back. If nobody’s producing, nobody’s consuming.

Market’s now factoring in negative interest rates.

Second wave of layoffs coming.

Businesses now at risk of regular shutdowns.

- Source, Peter Schiff

Friday, May 22, 2020

Peter Schiff: Fed Will Wipe Out Many Investors, Gold To Return as Reserve Currency

In this interview, Schiff comments on the risks of holding dollar-denominated assets and what investors should be buying instead.

- Source, Kitco News

Peter Schiff: The Economy is Far Weaker than Investors Believe

Tech stocks strong on hope. Government ready to sacrifice other businesses to save Boeing.

Fed feeding the same BS from 2008 about unwinding stimulus.

Financial stocks are the canaries in the coal mine, and they’re dropping dead.

National Debt passes 25 trillion dollars.

- Source, Peter Schiff Podcast

Tuesday, May 19, 2020

Peter Schiff: The Debt Bomb Has a Much Shorter Fuse Than Anyone Thinks

Tech stocks providing false sense of security for the markets.

Powell throws cold water on negative interest rate expectations. Trump beats the drums demanding negative interest rates.

Betting odds increase on Democrats taking the Senate.

Congressman now proposing to pay people to go off unemployment.

Restaurants will not recover from this. Entrepreneurs and business owners are the real heroes, not teachers. Swedish response was more responsible.

Inflation is a consequence of government, never the private sector. Gold and gold stock charts looking great as markets start to roll over. Home builders are in trouble.

- Source, Peter Schiff

Tuesday, May 5, 2020

Peter Schiff: The Questions Nobody Is Asking

The US stock market ended last week on an upswing and gold was down as optimism and risk-on sentiment returned. The optimism was due to a possible treatment for coronavirus along with some movement toward reopening the US economy. There seems to be some sentiment that the market has found its bottom.

Peter doesn't think so.

"I still am doubting this rally. I don't think the bear market is over. I don't think the bear market ends with stocks like Netflix and Amazon making new all-time record highs. I still think those stocks have to have some kind of comeuppance. I think they have to take those out and shoot them. So, I am looking for another sell-off in the broad markets."

Peter said there is one thing the market has going for it - the Federal Reserve. In fact, a lot of people seem to think that's all you need.

"As long as you've got the Fed on your side and they're going to keep on printing money, which they're going to do and they're going to print more and more of it, people are going to make a bet. And they're going to bet on the Fed by buying stocks. What they should be doing is buying gold."

Gold stocks have been strong in recent weeks, but some of the bigwigs on Wall Street are already talking like the gold rally is over. Peter said it's barely begun.

"For people to say, 'Hey, it's time to get out, the gold rally is over,' I mean, these are people who really have no clue what's going on in the gold market trying to convince people the gold rally is over when the fundamentals have never been better. I mean, it's not like the Fed is about to stop printing money. No! They're going to print more than ever before. In fact, because they have printed so much money so quickly, because the balance sheet has exploded, and because of all these new programs that are on the deck, not only the ones that have been enacted, but the programs that are on the deck, they're going to be printing money like crazy. So, you have the most bullish environment you can imagine for the mining sector yet they're saying we should sell these stocks."

The Federal Reserve balance sheet grew by another $284.7 billion. To put that into some perspective, during QE3, the balance sheet was growing by $80 per month. The balance sheet now stands at just under $6.4 trillion. That raises a question: how is the Fed ever going to shrink the balance sheet?

"Maybe people have decided they're never going to shrink it. But then what does that mean? Because, the Fed has to shrink the balance sheet at some point, which is going to be very, very disruptive to the economy, much more disruptive than when they tried to shrink the balance sheet before, which eventually blew up."

Remember, the Fed had to call off quantitative tightening long before coronavirus. The Fed cut interest rates three times last year.

"So, it's not like the Fed was able to keep shrinking the balance sheet and keep raising interest rates and it had to abort that process because of the coronavirus. They had to abort the process before anybody heard of the coronavirus. So, it was already imploding. The bubble was already deflating before this pin, this other pin came and put another hole in it. So, if we couldn't unwind the four-and-a-half trillion-dollar balance sheet, if we couldn't normalize the debt levels that existed before the coronavirus, think about how much more difficult, if not completely impossible that process is going to be after the coronavirus. So, nobody is asking: what is the implication of a balance sheet that is so enormous that it would be so disruptive to shrink, or because it's so enormous and can't be shrunk? What does that mean about future inflation and the value of the dollar?"

There is still this persistent myth that everything is going to be fine once we solve coronavirus. In the meantime, we're piling on trillions of dollars in new debt. That debt doesn't just go away after the coronavirus lockdown is over.

"We still have to deal with that problem long after the coronavirus problem is over. … It's not like all of a sudden we're going to go back to this booming economy. We're going to go back to a busted bubble."

As Peter has said before, all we can do is recover from a depression to a recession.

On top of all that, the government is going to end up killing more businesses than it saves with all of this "stimulus" and these loan programs.

- Source, Seeking Alpha

Saturday, May 2, 2020

Peter Schiff: Former Fed Chairs Still as Clueless as Ever

- Source, Schiff Podcast

Wednesday, April 29, 2020

More Economic Struggles Over the Horizon

- Source

Sunday, April 26, 2020

Peter Schiff: Is Recovering from Depression to Recession a Recovery?

Nothing is as permanent as a temporary government program. S&P reaffirms US AA+ rating.

- Source, Schiff Podcast

Wednesday, April 22, 2020

Peter Schiff: The Tide is Out and Everyone's Been Swimming Naked

The old saying about the piper having to be paid is an old saying for a reason.

- Source, Schiff Podcast

Saturday, April 18, 2020

Peter Schiff: The Fed's Medicine Makes the Economy Sicker

Government short circuiting capitalism Investors will rush to sell and there won’t be any buyers.

Politicians exploiting coronavirus to grab power, buy votes, hide blame.

- Source, Peter Schiff

Thursday, April 16, 2020

Peter Schiff: More QEs than Super Bowls

Trump draining the whole country instead of just the swamp - will add more debt in 4 years than Bush did in 8. Unemployed will stay unemployed for a long time.

We’re buying time before an explosive rise in gold prices. You can’t outperform a bubble. Betting against the economy is not the same as rooting against the economy.

Tuesday, April 14, 2020

Peter Schiff: Printing Money Doesn't Make Government Free

Employment is a hazard. Unemployment may become a gravy train.

Inflationary pressure mounting as companies retool their factories to make masks, ventilators, sanitizer, and other coronavirus related products.

Donald Trump is now the president of the United States AND the chairman of the Federal Reserve.

- Source, Peter Schiff

Friday, April 10, 2020

Currency Wars: The Rise of Hyperinflation

- Source, Peter Schiff

Sunday, March 29, 2020

Peter Schiff Was Right on Return to QE and ZIRP

- Source, Peter Schiff

Thursday, March 26, 2020

Sunday, March 22, 2020

Peter Schiff: Stimulus Overdose to Propel Gold to New Highs

Markets betting on a 50 basis point rate cut to interest rates and more quantitative easing. Part of the market rally likely also due to diminishing chance of a Bernie Sanders presidency.

But Biden will also be bad for the markets and he has a greater chance of winning Nothing goes up in straight lines. Bull markets have notoriously big declines as they climb the wall of worry, which we may have seen on Friday.

Gold stock positioned for record highs.

- Source, Peter Schiff

Thursday, March 19, 2020

Monday, March 16, 2020

Peter Schiff: Bailouts Spread Nationwide

We had a lot of stock market firsts this week and it was one of choppiest weeks on record.

Trump announces beginning of national bailout including open-ended moratorium on student interest loans, allowing debtors put their loans into deferment indefinitely and never pay them again.

Trump leaves door open to bailout any industry in the country.

Lawsuits driving many shutdowns across the country. Gold’s recent late day buys a sign of illiquid investors trying to get in at lows.

- Source, Peter Schiff

Friday, March 6, 2020

Peter Schiff: This Massive Stock Market Bubble Finally Found a Pin

The only way people can retire from their stock portfolio is to sell shares. Or if everybody is stuck in the same emergency, who are you going to sell your shares to?

I think this is the most overvalued stock market in history. It’s not the coronavirus . The market was going to go down anyway.

It’s not the size of the pin, but the size of the bubble. This is a massive bubble.

It finally found a pin.” Schiff says much bigger gains are coming in both gold and silver because of Fed easy money policies that will not fix the problem of “massive debt.”

- Source, USA Watchdog

A Fed Rate Cut is Terrible Medicine for the Infected Stock Market

While the mere hope of a rate cut is giving some traders courage, and an announcement would likely give stocks a bounce, not all analysts agree it will be good for a stock market. They see more liquidity as merely forestalling the inevitable pain.

In December economist and global financial strategist David Rosenberg warned the Federal Reserve’s “liquidity injection that’s ongoing” has fueled a dangerous bubble in risk assets like consumer credit and the stock market.

It’s no coincidence that the market overheated and went bust during the Federal Reserve’s “QE Lite” starting in September. That’s when the Fed started pumping $77 billion a month into overnight lending markets.

Big banks lend money to each other for 24 hours in these markets so they have enough cash on hand for withdrawals. Fed Chair Jerome Powell said the massive money injections were “not QE.” But the last round of Quantitative Easing, QE3 only pumped $40 billion a month into markets.

- Source, CCN

Monday, March 2, 2020

Why is This $400K Bitcoin Mega-Bull Running Scared of Peter Schiff?

Following Alex Jones recently encouraging fans to get into Bitcoin, the controversial radio presenter now seems to want to host a crypto-focused debate. His dream participants for the discussion are the outspoken Bitcoin mega-bull Max Keiser and anti-crypto gold bug Peter Schiff.

Whilst Schiff seems up for an appearance on Jones’s show, Keiser is reportedly less keen. Surely, one of Bitcoin’s loudest proponents isn’t afraid of debating Peter Schiff, is he?

Schiff, Keiser, and Jones… The Three-Way You Didn’t Know You Needed

According to Peter Schiff, Alex Jones has just invited him and Max Keiser to debate Bitcoin on his show. Jones is well known for his conspiracy-focused show, InfoWars.

In a recent edition of InfoWars, Jones hosted Max Keiser. During the show, Jones said that he should have taken Keiser’s advice and gotten involved with Bitcoin earlier.

Jones went on to say that he took his time endorsing the cryptocurrency because he would never promote something he was not completely sure about to his listeners. He now claims it is “smart to diversify” and that Bitcoin serves that end well. Its lack of government affiliation also seems to appeal to the talk show host’s conspiratorial side.

Peter Schiff was quick to comment on Jones’s bout turn today. The gold proponent and prominent Bitcoin naysayer said that this was a sure sign the Bitcoin “party” was “ending”.

Later today, the gold bug reported that Alex Jones had invited him to appear on InfoWars. Schiff would be given the opportunity to debate Max Keiser about Bitcoin.

However, it appears that the RT host of the “Keiser Report” doesn’t feel like going toe-to-toe with Schiff. As the gold investor reported, “Max refused the invitation”.

Schiff claims to have won the debate “by default”.

Whilst Schiff seems up for an appearance on Jones’s show, Keiser is reportedly less keen. Surely, one of Bitcoin’s loudest proponents isn’t afraid of debating Peter Schiff, is he?

Schiff, Keiser, and Jones… The Three-Way You Didn’t Know You Needed

According to Peter Schiff, Alex Jones has just invited him and Max Keiser to debate Bitcoin on his show. Jones is well known for his conspiracy-focused show, InfoWars.

In a recent edition of InfoWars, Jones hosted Max Keiser. During the show, Jones said that he should have taken Keiser’s advice and gotten involved with Bitcoin earlier.

Jones went on to say that he took his time endorsing the cryptocurrency because he would never promote something he was not completely sure about to his listeners. He now claims it is “smart to diversify” and that Bitcoin serves that end well. Its lack of government affiliation also seems to appeal to the talk show host’s conspiratorial side.

Peter Schiff was quick to comment on Jones’s bout turn today. The gold proponent and prominent Bitcoin naysayer said that this was a sure sign the Bitcoin “party” was “ending”.

Later today, the gold bug reported that Alex Jones had invited him to appear on InfoWars. Schiff would be given the opportunity to debate Max Keiser about Bitcoin.

However, it appears that the RT host of the “Keiser Report” doesn’t feel like going toe-to-toe with Schiff. As the gold investor reported, “Max refused the invitation”.

Schiff claims to have won the debate “by default”.

- Source, News BTC

Saturday, February 29, 2020

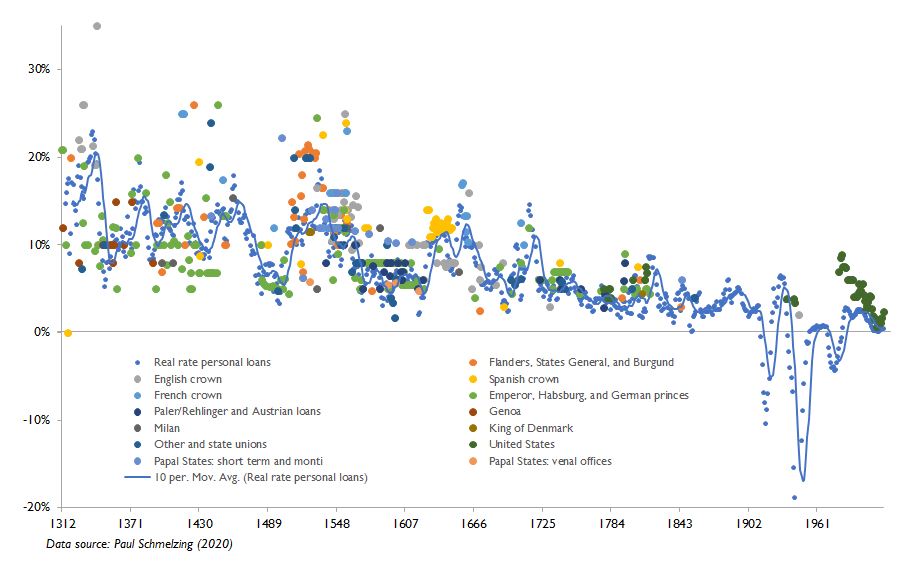

Eight Centuries of Interest Rates

Peter Schiff has called negative interest rates an absurdity, Kevin Muir thinks they are an abomination, and ex-Credit Suisse CEO Oswald Gruebel thinks they are crazy. But is today’s negative interest rate environment really so strange?

To understand the present, it always helps to step back and get the bigger picture. Which is why I want to spotlight a recent paper that mines through historical documents for 800 years worth of interest rate data.

In case you’ve missed it, many parts of the world are characterized by negative real interest rates. Investors in 5-year German bonds currently earn -0.6% per year in interest. That’s right. Investors must pay the government for the right to hold a bond for five years.

Compounding the burden of holding a German bond is inflation, which in Europe is expected to register at around 1.5% per year. Inflation eats into the value of a bond’s interest payments and principal. Combining the already negative interest rate with 1.5% inflation means that a German bond investor can expect a total negative return of around -2.1% per year.

Interest rates since 1311

On the face of it, a -2.1% return seems thoroughly outlandish. But in a recent Bank of England staff paper, economic historian Paul Schmelzing finds that negative interest rates aren’t that odd.Schmelzing has gathered an incredible 800-years of data on interest rates and inflation going back to the early 1300s.

Schmelzing’s data shows that real interest rates have been gradually falling for centuries. The real interest rate is the return that one gets on a bond or a loan after adjusting for inflation.

Interest rates on 454 personal/non-marketable loans to sovereigns, 1310-1946, and U.S. EE-series savings bonds (Source: Schmelzing, 2020).

Interest rates on 454 personal/non-marketable loans to sovereigns, 1310-1946, and U.S. EE-series savings bonds (Source: Schmelzing, 2020).

It shows interest rates on 454 loans made to sovereigns by court bankers and wealthy merchants.Data goes back to the early 1300s. These are non-marketable loans, meaning that they could not be resold on secondary markets. Included in this list is a 1342 loan made by Simon van Halen, the regent of Flanders, to the English king Edward III, to help him wage war on France. Van Halen extracted a princely 35% per year before inflation! Another loan is the Duke of Milan’s 218,072 Milanese pound debt to the Medici bank in 1459, which cost 15.4% per year.

As the chart illustrates, the real interest rate that lenders have demanded from sovereign borrowers over the last 800 years has been gradually declining. The 0.5% real interest rateon modern U.S. savings bonds, a close cousin of earlier courtly loans (they are also non-marketable) may seem low on first blush. But zooming out, the savings bond fits the trend quite accurately. It’s not far off what a lender might have expected to earn from the Habsburg Emperor in the 1790s.

Schmelzing’s paper has many curious details about medieval financial markets. Not included in his interest rate data, for instance, are loans denominated in various odd units. In times past, a lender might stipulate repayment in chickens, jewellery , land, fruit, wheat, rye, leases for offices, or some sort of entitlement. To keep calculation easier, Schmelzing only collects information on loan that are payable in cash.

Nor does Schmelzing include loans from Jewish communities in medieval times. These loans often used the threat of expulsion to extract artificially low interest rates.

To adjust the interest rate on loans for inflation, Schmelzing relies on consumer price data compiled by economic historian Robert Allen. Allen’s consumer price index baskets go back to the 14th century. He has constructed them for major cities like London and Milan using old records of items like bread, peat, wood, linen, soap, and candles. Prices are expressed in silver unit equivalents to correct fordebasement of the coinage.

Cultural differences are reflected in each city’s respective consumptionbaskets . For instance, the English basket features butter and beer, while the North Italian features olive oil and wine. Antwerp’s series includes rye bread, but in places where rye bread wasn’t as popular (ie . London and Paris), wheat bread is substituted...

To understand the present, it always helps to step back and get the bigger picture. Which is why I want to spotlight a recent paper that mines through historical documents for 800 years worth of interest rate data.

In case you’ve missed it, many parts of the world are characterized by negative real interest rates. Investors in 5-year German bonds currently earn -0.6% per year in interest. That’s right. Investors must pay the government for the right to hold a bond for five years.

Compounding the burden of holding a German bond is inflation, which in Europe is expected to register at around 1.5% per year. Inflation eats into the value of a bond’s interest payments and principal. Combining the already negative interest rate with 1.5% inflation means that a German bond investor can expect a total negative return of around -2.1% per year.

Interest rates since 1311

On the face of it, a -2.1% return seems thoroughly outlandish. But in a recent Bank of England staff paper, economic historian Paul Schmelzing finds that negative interest rates aren’t that odd.

Here is one chart that Schmelzing plots from the data he has collected.

Interest rates on 454 personal/non-marketable loans to sovereigns, 1310-1946, and U.S. EE-series savings bonds (Source: Schmelzing, 2020).

Interest rates on 454 personal/non-marketable loans to sovereigns, 1310-1946, and U.S. EE-series savings bonds (Source: Schmelzing, 2020).It shows interest rates on 454 loans made to sovereigns by court bankers and wealthy merchants.

As the chart illustrates, the real interest rate that lenders have demanded from sovereign borrowers over the last 800 years has been gradually declining. The 0.5% real interest rate

Nor does Schmelzing include loans from Jewish communities in medieval times. These loans often used the threat of expulsion to extract artificially low interest rates.

To adjust the interest rate on loans for inflation, Schmelzing relies on consumer price data compiled by economic historian Robert Allen. Allen’s consumer price index baskets go back to the 14th century. He has constructed them for major cities like London and Milan using old records of items like bread, peat, wood, linen, soap, and candles. Prices are expressed in silver unit equivalents to correct for

Cultural differences are reflected in each city’s respective consumption

- Source, Bullion Star

Thursday, February 27, 2020

Just because doomsayers warn of Armageddon doesn’t mean they’re right

Markets are doomed. Again. Warnings of looming Armageddon have become routine over the last decade, so it wasn’t surprising to hear another apocalyptic forecast at the recent World Economic Forum at Davos.

“Guggenheim says market a ‘ponzi scheme’ that must collapse,” headlined Bloomberg, following comments from Scott Minerd, the global chief investment officer of Guggenheim Partners. Loose monetary policy had inflated asset prices but investors would eventually “awake” to the rising tide of corporate bond defaults and downgrades, said Minerd. A “tipping point” will be reached and investors should expect a “severe” equity bear market with losses of 40 to 50 per cent. Guggenheim has more than $275 billion in assets under management and Minerd, a member of the New York Federal Reserve’s investor advisory committee on financial markets, is widely regarded as a thoughtful, experienced money manager. In other words, he is not regarded as a perma -bear given to wild scaremongering .

Nevertheless, we’ve been here before. “Markets are on ‘collision course for disaster’, says Guggenheim’s Minerd”, headlined MarketWatchin March 2018. “Guggenheim investment chief sees a recession and a 40 per cent plunge in stocks ahead”, reported CNBC a month later. Near the bottom of last May’s minor market pullback, Minerd warned of a “much more severe downturn before the end of the summer”, with stocks likely going “somewhere below the lows” at the end of 2019.

Investors who followed this advice lost out – the S&P 500 quickly recouped its losses and ended 2019 with gains of 29 per cent, its second-best year since 1997.

“Guggenheim says market a ‘

Nevertheless, we’ve been here before. “Markets are on ‘collision course for disaster’, says Guggenheim’s Minerd”, headlined MarketWatch

Investors who followed this advice lost out – the S&P 500 quickly recouped its losses and ended 2019 with gains of 29 per cent, its second-best year since 1997.

Apocalyptic commentary

Minerd is obviously entitled to share his concerns and healthy markets have always been made up of a mix of bullish and bearish voices. Nevertheless, the sheer volume of apocalyptic commentary today is different, noted a November report by JP Morgan strategist Michael Cembalest.

“Something peculiar happened after the global financial crisis: the rise of the Armageddonists,” said Cembalest, referring to the variety of money managers and forecasters “whose apocalyptic comments spread like wildfire”.

Armageddonist commentary differs from money managers adopting a “defensive posture”, said Cembalest, in that the latter are conservatively dialling down their risk profile while the former are effectively calls for “wholesale reductions in portfolio risk” due to expectations of “recession, bear markets, financial crises and general mayhem”.

The report contains a table containing Armageddonist commentary dating back to 2010 from 17 different observers. The tone tends to be certain: in 2011, high-profile bear and Gluskin Sheff strategist David Rosenberg said he was 99 per cent sure of a recession by the end of the following year; the odds of a near-term global recession were “100 per cent”, said Marc “Dr Doom” Faber in 2012; “I am 100 per cent confident the crisis that we’re going to have will be much worse than the one we had in 2008,” said money manager Peter Schiff in 2013. Some of the names on the list are widely perceived as investment cranks, although others are major figures. They include Jeffrey Gundlach, the billionaire bond manager who said in 2011 that it “seems suicidal” to buy stocks and who advised investors to “sell everything” in 2016. Legendary investor George Soros, who warned in 2016 that markets were facing a “serious challenge that reminds me of the crisis we had in 2008” is also there, as is billionaire investor Carl Icahn, who warned in 2015 of a “very massive bubble” and a “bloodbath”.

The table of 17 names was “not an exhaustive list”, said Cembalest, and it’s easy to think of other major figures who could have been included. Billionaire investors like Bill Gross, Stanley Druckenmiller and Paul Singer have all issued dire warnings at various stages over the last number of years...

“Something peculiar happened after the global financial crisis: the rise of the Armageddonists,” said Cembalest, referring to the variety of money managers and forecasters “whose apocalyptic comments spread like wildfire”.

The report contains a table containing Armageddonist commentary dating back to 2010 from 17 different observers. The tone tends to be certain: in 2011, high-profile bear and Gluskin Sheff strategist David Rosenberg said he was 99 per cent sure of a recession by the end of the following year; the odds of a near-term global recession were “100 per cent”, said Marc “Dr Doom” Faber in 2012; “I am 100 per cent confident the crisis that we’re going to have will be much worse than the one we had in 2008,” said money manager Peter Schiff in 2013. Some of the names on the list are widely perceived as investment cranks, although others are major figures. They include Jeffrey Gundlach, the billionaire bond manager who said in 2011 that it “seems suicidal” to buy stocks and who advised investors to “sell everything” in 2016. Legendary investor George Soros, who warned in 2016 that markets were facing a “serious challenge that reminds me of the crisis we had in 2008” is also there, as is billionaire investor Carl Icahn, who warned in 2015 of a “very massive bubble” and a “bloodbath”.

The table of 17 names was “not an exhaustive list”, said Cembalest, and it’s easy to think of other major figures who could have been included. Billionaire investors like Bill Gross, Stanley Druckenmiller and Paul Singer have all issued dire warnings at various stages over the last number of years...

- Source, The Irish Times

Tuesday, February 25, 2020

Fed Will Cut Rates Back Down to Zero, Balance Sheet to Explode

Gold hit its highest level in almost seven years, touching $1,594.70 an ounce Monday, and gold bugs may see further gains thanks to Sen. Bernie Sanders, I-Vt.

The chances of a Sanders presidency are on the rise, according to a Fox News poll released Sunday which showed 23 percent of Democratic primary voters prefer the Vermont Senator, up from 20 percent in December. The poll found that former Vice President Joe Biden remains the frontrunner for the Democratic nomination at 26 percent, but that was down from 30 percent last month. Sanders matches up favorably against President Trump, leading 48 percent to 42 percent in a head-to-head matchup.

“If Sanders becomes president in 2020, the price of gold will be well above $2,000 on the day after election night,” Peter Schiff, chief executive officer and president of the Westport, Conn.-based Euro Pacific Capital told FOX Business. He added that the precious metal could reach $2,000 before the election if the market thinks Sanders is going to win.

“What a Sanders win means is much bigger government deficits, and much more money printing by the Fed because there is no way to finance all of the spending that will happen with tax hikes on the rich,” Schiff said. “We’ll get tax hikes on the rich, but they’re not going to provide the revenue to pay for the programs.”

Schiff believes the U.S. budget deficit, which was up 11.8 percent through the first three months of this budget year to $356.6 billion and on track to top $1 trillion for the first time in eight years, would balloon even further under a Sanders presidency. He is also promising to cancel more than $1 trillion of U.S. student debt and has also been a proponent of other massive spending projects like the Green New Deal.

“There is gonna be no Republican opposition to the deficits that would finance the spending because after all, the Republicans didn’t object to record deficits under Trump when the economy was supposedly the greatest ever,” Schiff said. “The deficits could be three or four trillion dollars a year and the money printing will be off the charts.”

As for the coronavirus and any potential impact it might have on the price of the precious metal, Schiff says that gold was rallying before the outbreak and that it is “not why” the price is going up even though metals are considered a safe-haven amid uncertain times.

Analysts at J.P. Morgan examined the 2003 outbreak of SARS, and found gold’s price rose by more than 8 percent in the two-and-a-half months after the World Health Organization issued an emergency travel advisory in mid-March, but said the U.S. invasion of Iraq and an easing cycle by the Federal Reserve “muddy the water immensely.” They say gold will hit $1,655 and possibly even $1,715 based on the technical set up.

Looking ahead, gold investors will be paying close attention to the Federal Reserve’s upcoming two-day policy meeting which concludes on Wednesday.

While the central bank is expected to keep rates unchanged, investors will be focused on any commentary regarding the expansion of its balance sheet by about $400 billion over the past few months through short-term repo operations and the purchase of Treasury bills.

Schiff thinks the Fed will cut rates back down to zero at some point in the future, and that its balance sheet will “explode to a much higher than the four-and-a-half trillion that they tapered from.”

“There’s no way the dollar’s reserve status will survive a Sanders presidency,” Schiff said. “America is going to be a much, much poorer nation. Our standard of living is going to implode, but the money printing is going to be crazy.”

The chances of a Sanders presidency are on the rise, according to a Fox News poll released Sunday which showed 23 percent of Democratic primary voters prefer the Vermont Senator, up from 20 percent in December. The poll found that former Vice President Joe Biden remains the frontrunner for the Democratic nomination at 26 percent, but that was down from 30 percent last month. Sanders matches up favorably against President Trump, leading 48 percent to 42 percent in a head-to-head matchup.

“If Sanders becomes president in 2020, the price of gold will be well above $2,000 on the day after election night,” Peter Schiff, chief executive officer and president of the Westport, Conn.-based Euro Pacific Capital told FOX Business. He added that the precious metal could reach $2,000 before the election if the market thinks Sanders is going to win.

“What a Sanders win means is much bigger government deficits, and much more money printing by the Fed because there is no way to finance all of the spending that will happen with tax hikes on the rich,” Schiff said. “We’ll get tax hikes on the rich, but they’re not going to provide the revenue to pay for the programs.”

Schiff believes the U.S. budget deficit, which was up 11.8 percent through the first three months of this budget year to $356.6 billion and on track to top $1 trillion for the first time in eight years, would balloon even further under a Sanders presidency. He is also promising to cancel more than $1 trillion of U.S. student debt and has also been a proponent of other massive spending projects like the Green New Deal.

“There is gonna be no Republican opposition to the deficits that would finance the spending because after all, the Republicans didn’t object to record deficits under Trump when the economy was supposedly the greatest ever,” Schiff said. “The deficits could be three or four trillion dollars a year and the money printing will be off the charts.”

As for the coronavirus and any potential impact it might have on the price of the precious metal, Schiff says that gold was rallying before the outbreak and that it is “not why” the price is going up even though metals are considered a safe-haven amid uncertain times.

Analysts at J.P. Morgan examined the 2003 outbreak of SARS, and found gold’s price rose by more than 8 percent in the two-and-a-half months after the World Health Organization issued an emergency travel advisory in mid-March, but said the U.S. invasion of Iraq and an easing cycle by the Federal Reserve “muddy the water immensely.” They say gold will hit $1,655 and possibly even $1,715 based on the technical set up.

Looking ahead, gold investors will be paying close attention to the Federal Reserve’s upcoming two-day policy meeting which concludes on Wednesday.

While the central bank is expected to keep rates unchanged, investors will be focused on any commentary regarding the expansion of its balance sheet by about $400 billion over the past few months through short-term repo operations and the purchase of Treasury bills.

Schiff thinks the Fed will cut rates back down to zero at some point in the future, and that its balance sheet will “explode to a much higher than the four-and-a-half trillion that they tapered from.”

“There’s no way the dollar’s reserve status will survive a Sanders presidency,” Schiff said. “America is going to be a much, much poorer nation. Our standard of living is going to implode, but the money printing is going to be crazy.”

- Source, Fox News

Sunday, February 23, 2020

Friday, February 21, 2020

The Fed is Going to Ensure Gold and Silver Move Higher

"The Fed’s not going to do anything about it. So, we’re going to have higher inflation. We’re going to have slower growth. I think we could see a push up in long-term interest rates as the dollar really starts to weaken. And that destroys the appetite for US dollar-denominated debt.

So, if you have higher consumer prices and higher interest rates, that’s a negative for the economy. But it’s a positive for gold, because the Fed is going to try to rescue the economy by printing even more money, and all that’s going to do is stoke the inflationary fire. So, I think we’re going to see a big up move, not just in 2020, but probably for the remainder of this decade.

You’re going to see the type of move we had in the first decade of this century. Remember, gold did really well from 2001 to 2010 timeframe. So, in the teens, gold really treaded water. This is going to be the next leg up and I think this is going to be an even more explosive decade for gold than the first decade of this century.”

- Source, Schiff Gold

Tuesday, February 18, 2020

Peter Schiff: The 20’s Will Be An Explosive Decade for Gold

- Source, Schiff Gold

Sunday, February 16, 2020

Peter Schiff: Market Is an Inflation-Driven Bubble Ready to Pop

Euro Pacific Capital CEO and economist Peter Schiff’s outlook for the U.S. stock market in 2020 isn’t very optimistic, and it’s not because of the coronavirus — yet.

“Look, obviously, it’s too early to tell if there’ll be any kind of impact or meaningful impact on global trade, GDP or the markets as a result of this virus,” Schiff said in a recent interview on RT Boom Bust.

The perennial gold bull thinks the real issue with the market is that stocks are extremely overvalued, thanks to the Federal Reserve, which he argues has created a fake rally through its “stealth quantitative easing” action that’s pumping fake money into the system.

“It should be coming down. The only thing really supporting it is the Federal Reserve and all the money they’re printing with their stealth QE program, although it’s not stealth really,” Schiff said. “Everybody knows they’re doing it. They just refuse to admit it.”

Dallas Fed Chief Robert Kaplan even admitted that the central bank’s action is affecting assets earlier this month.

“My own view is it’s having some effect on risk assets,” Kaplan said. “It’s a derivative of QE when we buy bills and we inject more liquidity — it affects risk assets. This is why I say growth in the balance sheet is not free. There is a cost to it.”

Schiff thinks the market isn’t being bolstered by factors that normally drive a rally, and soon enough the bubble is going to burst.

“There’re no earnings behind this,” he said. “There’s no strong economy behind this. This is an inflation-driven bubble, but the air should be coming out.”

And speaking of bubbles, Schiff points to another bubble in the U.S. auto industry that has been enabled by none other than … the Fed.

“I think the U.S. auto sector is another bubble that was made possible by the Fed,” Schiff argues. “You have Americans who are buying cars with seven or eight-year loans, where they’re lying about their incomes just to qualify. So I think you have a dangerous auto bubble here.”

Schiff thinks that auto bubble will lead to a contraction in the U.S. auto market — where delinquencies are at an eight-year high — but foreign auto markets may actually get stronger.

“Particularly in places like China, where people don’t borrow money to buy cars. They buy cars they can actually afford using the money they actually have,” Schiff jabbed.

And he doesn’t think U.S. President Donald Trump’s threat to hit the EU with auto tariffs will work simply because the U.S. isn’t competitive in the sector.

“When you live in glass houses, you’re not supposed to throw stones,” Schiff said of the tariffs. “And we haven’t been playing fair in that part of the market.”

The U.S. gross domestic product for 2019 hit a three-year-low 2.3%, and Schiff thinks the ongoing recession in U.S. manufacturing is bound to hit the service sector soon.

“It’s long overdue,” Schiff argued. “Obviously, there’s a lot of politics involved now in whether they can kick the can down the road long enough to kick the recession past the 2020 election.”

Schiff thinks that if a recession does happen this year, there’s no way Trump wins his reelection bid in November. And he pointed out that if Democratic Socialist Bernie Sanders were to take the presidency, it would “be very dangerous for the U.S. stock market,” but he said Monday it would be great for gold.

“There is a lot of risk to the U.S. economy,” he said, “and the U.S. market that everybody is ignoring at the moment.”

“Look, obviously, it’s too early to tell if there’ll be any kind of impact or meaningful impact on global trade, GDP or the markets as a result of this virus,” Schiff said in a recent interview on RT Boom Bust.

The perennial gold bull thinks the real issue with the market is that stocks are extremely overvalued, thanks to the Federal Reserve, which he argues has created a fake rally through its “stealth quantitative easing” action that’s pumping fake money into the system.

“It should be coming down. The only thing really supporting it is the Federal Reserve and all the money they’re printing with their stealth QE program, although it’s not stealth really,” Schiff said. “Everybody knows they’re doing it. They just refuse to admit it.”

Dallas Fed Chief Robert Kaplan even admitted that the central bank’s action is affecting assets earlier this month.

“My own view is it’s having some effect on risk assets,” Kaplan said. “It’s a derivative of QE when we buy bills and we inject more liquidity — it affects risk assets. This is why I say growth in the balance sheet is not free. There is a cost to it.”

Schiff thinks the market isn’t being bolstered by factors that normally drive a rally, and soon enough the bubble is going to burst.

“There’re no earnings behind this,” he said. “There’s no strong economy behind this. This is an inflation-driven bubble, but the air should be coming out.”

And speaking of bubbles, Schiff points to another bubble in the U.S. auto industry that has been enabled by none other than … the Fed.

“I think the U.S. auto sector is another bubble that was made possible by the Fed,” Schiff argues. “You have Americans who are buying cars with seven or eight-year loans, where they’re lying about their incomes just to qualify. So I think you have a dangerous auto bubble here.”

Schiff thinks that auto bubble will lead to a contraction in the U.S. auto market — where delinquencies are at an eight-year high — but foreign auto markets may actually get stronger.

“Particularly in places like China, where people don’t borrow money to buy cars. They buy cars they can actually afford using the money they actually have,” Schiff jabbed.

And he doesn’t think U.S. President Donald Trump’s threat to hit the EU with auto tariffs will work simply because the U.S. isn’t competitive in the sector.

“When you live in glass houses, you’re not supposed to throw stones,” Schiff said of the tariffs. “And we haven’t been playing fair in that part of the market.”

The U.S. gross domestic product for 2019 hit a three-year-low 2.3%, and Schiff thinks the ongoing recession in U.S. manufacturing is bound to hit the service sector soon.

“It’s long overdue,” Schiff argued. “Obviously, there’s a lot of politics involved now in whether they can kick the can down the road long enough to kick the recession past the 2020 election.”

Schiff thinks that if a recession does happen this year, there’s no way Trump wins his reelection bid in November. And he pointed out that if Democratic Socialist Bernie Sanders were to take the presidency, it would “be very dangerous for the U.S. stock market,” but he said Monday it would be great for gold.

“There is a lot of risk to the U.S. economy,” he said, “and the U.S. market that everybody is ignoring at the moment.”

- Source, Money and Markets

Friday, February 14, 2020

Peter Schiff: Nothing But Bullish News for Gold, Yet Prices Have Gone Down

"Gold isn’t just an inflation hedge. It is predominantly that. The main reason gold is going up is because of the Fed. But obviously, in a world where you have heightened geopolitical risk, which could adversely affect bond markets and stock markets, you would expect to see greater demand for gold as a hedge in your portfolio. And that’s why the price of gold was up better than $20 an ounce today (Friday).

History shows that under most outcomes gold will likely rally to well beyond current levels. That’s consistent with our previous research, which shows that being long gold is a better hedge to such geopolitical risks.

When you factor in ongoing uncertainty with respect to US-China trade talks and heightened security issues with Iran, gold really is a no-brainer.

We’ve had nothing but bullish news for gold stocks. We have a $30 move up in the price of gold. We have heightened geopolitical risk associated with gold. Yet the gold stocks have gone down. Why is that? Again, I think you’ve got a lot of fearful traders. There’s a wall of worry in this bull market. There’s a lot of skepticism in the gold rally, which I regard as being healthy. You don’t have a devil-may-care, throw caution to the wind type of attitude the way you have it in the S&P 500. People are nervous in the gold stock market."

History shows that under most outcomes gold will likely rally to well beyond current levels. That’s consistent with our previous research, which shows that being long gold is a better hedge to such geopolitical risks.

When you factor in ongoing uncertainty with respect to US-China trade talks and heightened security issues with Iran, gold really is a no-brainer.

We’ve had nothing but bullish news for gold stocks. We have a $30 move up in the price of gold. We have heightened geopolitical risk associated with gold. Yet the gold stocks have gone down. Why is that? Again, I think you’ve got a lot of fearful traders. There’s a wall of worry in this bull market. There’s a lot of skepticism in the gold rally, which I regard as being healthy. You don’t have a devil-may-care, throw caution to the wind type of attitude the way you have it in the S&P 500. People are nervous in the gold stock market."

- Source, Peter Schiff

Wednesday, February 12, 2020

News Bites $2000 gold price by election night is possible

“I think if Trump is not re-elected, if we get like, President Sanders, gold should go above $2,000 this year, and if it’s not above $2,000 by election, it should be $2,000 election night once we get the results,” Schiff told Kitco News on the sidelines of the Vancouver Resource Investment Conference.

- Source, Kitco News

Subscribe to:

Comments (Atom)